Guest blog article by R. Sanjay Mishr with contributions from David Steinmetz/ Callirius

In the face of climate change, the global community has turned to nature-based solutions like ecosystem restoration projects, leveraging them as essential tools for holistic climate action. Amidst this shift, the Voluntary Carbon Market (VCM) plays a critical role in financing such initiatives. However, recent scrutiny due to some projects’ dubious practices and false environmental claims has highlighted the urgent need for integrity and transparency. It’s these very values that are embedded in the core of the Callirius Carbon Removal Fund Opportunity, which stands as a strategic investment in our planet’s future.

By locking in today’s prices for carbon credits, Callirius offers a prescient solution to market volatility, with a portfolio that’s as diverse as it is robust—comprising high-quality, insured carbon removal projects. Under the stringent BaFin regulation, each project in the portfolio is scrupulously vetted for its potential to restore and enhance nature and biodiversity. This approach not only counters risk but also amplifies the positive ecological and socioeconomic impacts, steering us toward a more sustainable existence.

Callirius’s commitment to high-integrity carbon projects—each one additional, verified, credible, and transparent—ensures that trust is rebuilt in the VCM and impactful climate action is taken. Through our innovative climate financing platform, effective nature-based carbon projects can secure the necessary funds, while companies and investors are granted transparent access to top-tier, nature-based carbon projects.

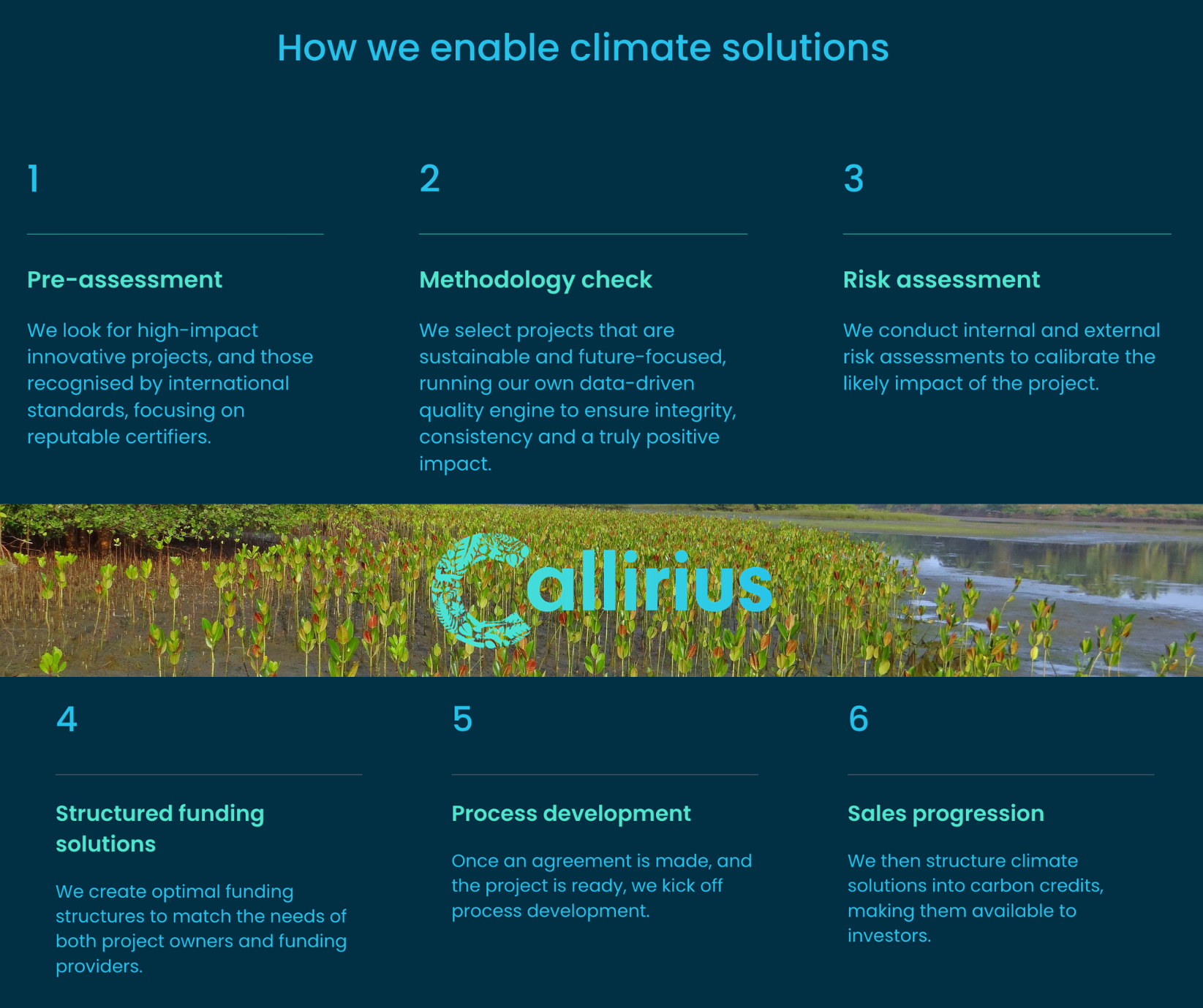

We have established a rigorous screening process, based on the Callirius Quality Framework (CQF), to identify and support projects that not only promise meaningful impacts but also uphold the highest standards of transparency and accountability in the VCM:

- Pre-eligibility assessment: Callirius assesses the project’s pre-eligibility based on a set of pre-assessed and pre-approved criteria.

- Eligibility assessment: Callirius conducts a more in-depth assessment of the project based on project-type-specific guiding questions to determine the final eligibility of the projects that we offer in our Project Portal.

- Continuous monitoring process: In this step, Callirius lists the project on its Project Portal if it meets all of the criteria. All these projects are subject to continuous monitoring for transparency and accountability, helping to build stakeholder confidence by providing transparent and reliable information on the project’s performance.

To find out more about our quality approach, watch the interview below.

Core characteristics of selected high-quality, nature-based carbon projects for the Carbon Removal Fund

A high-quality carbon project provides assurance throughout its life cycle, from project planning to credit issuance and retirement to impact beyond the end of its crediting period. While selecting the project for our carbon removal fund portfolio, we keep in mind several core characteristics that contribute towards high project quality:

- Additionality: The idea that emission reductions and removals should produce additional abatement compared with a reference scenario that would have occurred without the market-based mechanism.

- Realistic and credible baselines: The project must realistically present and credibly explain the expected greenhouse gas emissions without the planned intervention. This baseline serves as an essential reference for accurately measuring and verifying a project’s emission reduction and removal achievements.

- Robust quantification and monitoring framework: The project needs a structured approach for accurately measuring and reporting project impacts with established methodologies, quality assurance, third-party verification, and continuous improvement, ensuring data reliability and credibility.

- Permanence: The project must ensure that once carbon is removed from the atmosphere, it remains stored securely for a prolonged period (depending upon project type). A non-permanence risk assessment must be combined with a sufficient buffer pool, proactive risk mitigation strategy and a contingency plan.

- Avoiding double counting of the emission reductions or removals: The project developers, carbon methodologies, standards and registries must implement measures to prevent the same emission reduction or removal being claimed, used or reported more than once.

- Facilitating transition towards global net-zero emission target: The implementation of the project must facilitate, rather than delay or impede, a transition towards achieving global net-zero greenhouse gas emissions, as per the Paris Agreement.

- Multiple environmental and socio-economic co-benefits: A project should achieve impacts beyond the climate impacts, such as strengthening climate resilience, improving livelihoods, supporting vulnerable communities and enhancing biodiversity.

- Strong focus on multiple demonstrating Sustainable Development Goals (SDGs) impact:

A project’s alignment with the United Nations Sustainable Development Goals (SDGs) is a key criterion for Callirius. It is essential that the projects can demonstrate the impact they have on these goals as a result of their activities.

Additional project selection attributes

- Feasibility study, project timeline, expected credit issuances: Callirius mandates that all prospective projects submit comprehensive feasibility studies, definitive timelines, and anticipated credit issuances throughout the crediting period. A robust project design document is vital to gauge both the feasibility and the potential impact of the project.

- Financial clarity: The financial evaluation process is stringent and requires complete transparency. A detailed financial blueprint that outlines both the expenditures and income projections is crucial. This should resonate with the financial requirements necessary for the project’s triumph.

- Authorization or accreditation with government or local administrative bodies: A project’s standing is significantly bolstered if it has secured approvals or accreditations from relevant governmental or local authorities. Adherence to legal and regulatory standards is a non-negotiable aspect of the selection process.

- Low country risk: Callirius places high importance on a country’s stability and regulatory environment when assessing project risks. Projects originating from countries with robust governance, political stability, and low corruption levels are more favorable.

- Alignment with Article 6 of the Paris Agreement: Priority is given to projects from nations that are actively engaged in the carbon credit market, as evidenced by their adherence to Article 6 of the Paris Agreement. Such commitment must be accompanied by the necessary endorsements and adjustments required by the Agreement.

- Explorer.land profile: A detailed and active profile on Explorer.land is seen as a positive factor during project scrutiny, providing essential geographic and project-specific data that facilitate the assessment process.

- Adherence to Recognized Carbon Standards: Callirius expects projects to comply with established carbon standards, which signifies a commitment to the veracity and accountability of their climate impact efforts. Projects should have a structured mechanism for the precise measurement and reporting of their impacts, backed by quality assurance, third-party audits, and a commitment to ongoing improvement.

- Clear land tenure and land rights: Transparency regarding land tenure and land rights is crucial for the viability and sustainability of projects, as it helps to mitigate potential conflicts and legal challenges.

Reasons for project rejection during preliminary assessment

- Incomplete submission: Proposals lacking in essential details, such as carbon credit projections, clear funding timelines, and comprehensive project data, are typically not accepted.

- Portfolio incompatibility: Callirius prioritizes projects that complement its existing portfolio, focusing on ecosystem restoration and climate solutions like forestation, wetlands, soil and land conservation, coastal and marine projects, biochar application, and rock weathering techniques. Proposals misaligned with these areas are often excluded.

- Absence of clarity on intervention types: Projects with vague or overly complex intervention strategies face rejection due to the potential risks associated with unclear activities.

- Ambiguous impact: Projects must clearly delineate their expected environmental impact, ensuring that they contribute additional benefits beyond existing solutions and provide a contextual baseline for their initiatives.

- Funding needs mismatch: Callirius allocates funding ranging from 1 to 10 million euros per project, based on a thorough analysis of capital expenses, operational expenses, and anticipated revenues. A mismatch in funding requirements can lead to disqualification.

- Absence of project lifecycle details: It is critical for projects to present a full lifecycle outline, including the initiation, operation, and credit issuance phases. Omission of these details can result in rejection.

- Stakeholder engagement: Proposals should outline a clear plan for engaging with local communities and stakeholders, ensuring the project’s social acceptability and support.

- Technological viability: The application of proven technologies or innovative approaches with a demonstrable track record of success is crucial for a project’s acceptance.

- Scalability and replicability: Projects that exhibit potential for scalability and replicability may have a competitive advantage, as they offer opportunities for broader impact and learning.

Projects failing to meet these comprehensive criteria are likely to be deemed unsuitable for Callirius’s project portfolio.

In conclusion, Callirius stands at the forefront of innovative climate action, wielding a meticulously crafted portfolio that serves as a beacon of integrity and impact within the Voluntary Carbon Market. Through our unwavering commitment to due diligence, transparency, and continuous monitoring, we not only foster confidence among stakeholders but also propel meaningful strides toward a net-zero future.

Our Carbon Removal Fund Opportunity embodies a forward-thinking approach to environmental stewardship, ensuring that investments today leave a lasting legacy of sustainability, biodiversity, and resilience for the generations to come. As we collectively navigate the complexities of climate financing and carbon reduction, Callirius remains dedicated to nurturing projects that are not just promises but are tangible pathways to a greener, more viable planet.